NB! The next regular deal date will be on December 11, 2017.

Globe is a investment product of Versobank AS that enables You to invest to the stock markets, using small amounts of money. A minimum size of a one-time investment is 45.00 EUR in a month. From this investment, a fee of 1.60 EUR is charged. It is also possible to invest more than 45.00 EUR in one month and at the same time there is no obligation to invest every month, so You can freely skip a few months of investing. The purpose of the product is to give You the freedom to invest as much as You want, if and when You want and to give You the opportunity to invest small amounts of money so that it would be possible for everyone to put money to work for them. The amount that You want to invest, will be allocated by our team to a global investment portfolio, specifically put together by our specialists. Your portfolio will consist of low cost index funds that invest in shares of companies in different regions of the world. You will have exposure for example to the US, German, Brazilian , Russian and South-African companies and respective bonds to name only a few. At the moment it is possible to choose one of two portfolios:

Globe Classic or Globe Emerging Markets or both of them at the same time.

PORTFOLIO 1: Globe Classic

Ticker | Name | Weight | Currency | Exchange |

EFA | 33.3% | USD | NYSE | |

VTI | 33.3% | USD | NYSE | |

VWO | 33.3% | USD | NYSE |

There are 3 index funds in the Classic portfolio:

Vanguard Total Stock Market ETF (VTI)

The fund consists of all the listed companies on all the American stock exchanges. There are over 3600 companies in this fund. Although this is purely an US based fund, many bigger American companies derive a large part of their earnings from foreign countries, giving investors exposure to other markets besides the US as well. The annual fee for this fund is 0,07% which makes it one of the cheapest fund there is. Fund is managed by Vanguard Quantitative Equity Group and is listed in USA on NYSE;

Vanguard Emerging Markets ETF (VWO)

This index fund invests in companies that are listed on the exchanges of emerging markets. These include for example South- Korea, Taiwan, Brazil, China, Russia, India, Morocco, Chile, Jordan and other interesting countries and their enterprises. The annual expense ratio for this fund is 0,25%. Fund is managed by Vanguard Quantitative Equity Group and is listed in USA on NYSE;

iShares MSCI EAFE Index Fund (EFA)

This index fund invests into stock markets of the developed countries outside USA such as the UK, Australia, Switzerland, Japan, Germany, France etc. The fund covers about 85% of the market capitalization of its underlying region. The annual expense ratio is 0,34%. Fund is managed by BlackRock Fund Advisors and is listed in USA on NYSE.

The Globe Classic portfolio is suitable for investors who take a long term view and positions in the market and are confident in knowing that by investing in stocks and diversifying, they will probably make money over a period of time and profit from the global economic growth.

PORTFOLIO 2: Globe Emerging Markets

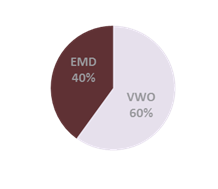

Ticker | Name | Weight | Currency | Exchange |

VWO | 60.0% | USD | NYSE | |

EMD | 40.0% | USD | NYSE |

Globe Emerging Markets consists of 2 index funds:

60% of the money You wish to invest will be allocated to Vanguard Emerging Markets ETF (VWO), a fund that invests in companies that are listed on the exchanges of emerging markets. These include for example South- Korea, Taiwan, Brazil, China, Russia, India, Morocco, Chile, Jordan and other interesting countries and their enterprises. The annual expense ratio for this fund is 0,25%. Fund is managed by Vanguard Quantitative Equity Group and is listed in USA on NYSE;

The other 40 % will be placed into a bond fund Western Asset Emerging Markets Debt Fund, Inc (EMD).

This fund invests into bonds of countries with developing and fast growing economies and companies listed on the exchanges of these markets. In its portfolio the fund has bonds of the Brazilian, Turkish, Mexican, Russian and Colombian governments and companies. The fund has paid monthly dividends for the last 3 years. The monthly dividend payments have been in stock. The annual expense ratio for EMD is 1,25%.Fund is managed by Legg Mason Partners Fund Advisor ja Western Asset and is listed in USA on NYSE.

The Globe Emerging Markets portfolio is suitable for investors who believe that countries with rapid economic growth will be able to sustain that growth in the future and increase their importance in the global economy. We believe that the emerging countries will provide the best relative growth opportunities in the future but investors should also recognise the higher risks and volatility that comes with investing to the emerging markets.

Investing via Globe is very simple

The process of investing has been made very easy. The client will get two accounts in Versobank AS – a regular account that is used for Globe exclusively and a separate account for the securities. The client will transfer the money that he/she wants to invest to the account tied with Globe 45.00 EUR as a minimum per each portfolio and once a month, on every second Monday of a given month, the brokers of Versobank AS will invest the clients money on behalf of the client into the portfolio that the client has chosen. The securities will then be transferred to Your securities account.

For the purposes of transferring the money, it is possible and recommended by us to make an automatic transfer order so that You would not forget to transfer the money or transfer it to the wrong account by accident. We believe that the best results will be achieved by the people who put their saving and investing on autopilot and then stick with their plan for a long period of time, regularly investing small amounts of money.

Globe stock purchases will be made for people that have the minimum required amount of money 45.00 EUR, transferred to their Globe accounts by 10.00 am on the second Monday of the month (deal day). Clients who have chosen to invest in both portfolios have to transfer the minimum amount for each of the portfolios i.e. 90.00 EUR in total for the purchases to be made. All the necessary currency conversions and other actions will be made by Versobank AS team. Before making the transactions, the fee of 1.60 EUR per portfolio will be deducted from the account. The transactions will be made following the US market open on the deal day in the extent of the money that the client has transferred to the account and the securities will be transferred to the respective accounts on the following business day. On the occasion that on the deal day there is not enough money on the account for the portfolio transaction to be carried out, the money will stay on the account and wait for the next deal day or until it is transferred out of the account.

There will be no active management of the portfolios and no trading because the goal is not to take on large risks, but the stable growth of the portfolio while keeping the expenses as low as possible. Investing periodically in such a way has its merits – there will be considerably less dependence on the short term fluctuations of market prices because you buy more, when prices are low and less when they are high, therefore Your average price will be sensible over a period of time. Moreover, You will have cumulative interest on Your side. By investing 45.00 EUR every month, it will take You 29 years to reach 100,000.00 EUR, provided that the markets average 10% of growth every year. 29 years is not an unreasonable period of time for most of us. It will also soften the effects of inflation on your capital because investing will be diversified over time, giving You the possibility to adjust the amount that You are able to invest every month.

Investing via Globe is cheap

The fee to invest in one portfolio is 0,75% of the invested sum, minimum 1.60 EUR. So, if You invest less than 213.02 EUR a month, Your fee will be 1.60 EUR. If you invest more, the fee will be 0,75%. Compared to regular fees, that are a few hundred EUR per trade, it is very cheap, considering that You get 2 or 3 different funds for one small fee.

Once every month You will be charged an account maintenance fee of 0,05% of the size of the portfolio, minimum 0.64 EUR. This will be charged even if You do not invest anything in a given month.

You can sell Your securities at anytime that you wish. Sell – trades are treated as regular trades and regular transaction fees will also be applicable.

If You have any additional questions, please do not hesitate to contact our specialist.

Contracts can be signed at Versobank AS office.

IMPORTAND RISK DISCLAIMER!

Current investment product is a financial service consisting of investments into exchange traded funds (ETF). Exchange traded funds do not offer guaranteed returns and past perfomance cannot guarantee future returns.

There is no guarantee that the invested amount will be maintained or will grow.

Investor can lose substantial part of the investment.

Before signing the agreement please read the contract terms and make sure you understand the risks involved and if needed consult investment adviser.